- Beauty News

- Cosmetify Beauty Trends Report

Cosmetify Beauty Trends Report 2026

The Data Behind the Brands & Beauty Buying Behaviours Shaping the Year Ahead

Contents

- Executive Summary

- 1. How Beauty Is Changing in 2026

- 2. The UK’s Most-purchased Beauty Brands of 2025

- 3. Brand Innovation Index

- 4. The Loyalty Leaders: Brands Shoppers Will Repurchase in 2026

- 5. What Factors Influence Beauty Purchases?

- 6. Generational Beauty Trends: Gen Z, Millennials & Boomers

- 7. What Shoppers Want to See More of in 2026

- 8. The Decline of Influencer Power

Executive Summary

The Cosmetify Index looks at the brands that have been dominating headlines and social media each year. But what do the people really think? We conducted a survey to find out the attitudes towards the brands that topped the charts of our 2024 index, to see if they’ll stand the test of time in future.

Key Insights

- Product performance and quality is the #1 beauty purchase driver in the UK, according to 348/484 (71.9%) respondents.

- Charlotte Tilbury dominates sales, but Gen Z & Millennials agree that Rhode is more innovative.

- Legacy brand Dior Beauty leads UK beauty loyalty: 44.6% of respondents (216/484) say they will continue buying from the brand in 2026.

- Sustainability ranks just 10th in beauty purchase priorities, falling behind packaging, social trends and affordability.

Conclusions and Recommendations for Brands

Given the dominance of efficacy as a purchase driver, brands should prioritise before/after visuals, clinical claims, ingredient transparency and science-backed storytelling. Whilst most consumers still want to see affordable products come to market, our research shows that they’re still willing to invest in new beauty products and ingredients that work.

1. How Beauty Is Changing in 2026

Loyalty is increasingly difficult to earn, with fleeting TikTok beauty trends thrusting customers from one brand to another. WWD announces that Clean Girl is officially out, despite once dominating every headline. Whereas, Mintel predicts that ‘2026 will be the tipping point for merging beauty and health, driven by consumers’ focus on holistic wellness’ and suggests ‘beauty is entering a new phase where health, technology and personalisation converge.’

Our findings echo this trend, with ‘new skincare ingredients’ taking second place (39.7% of votes) on shoppers’ requests from brands for 2026, outranking the demand even for inclusive shade ranges (19.4% of votes). Brands must find ways to cut through the noise and decision fatigue, bringing products to market that will positively impact the inside as well as the external.

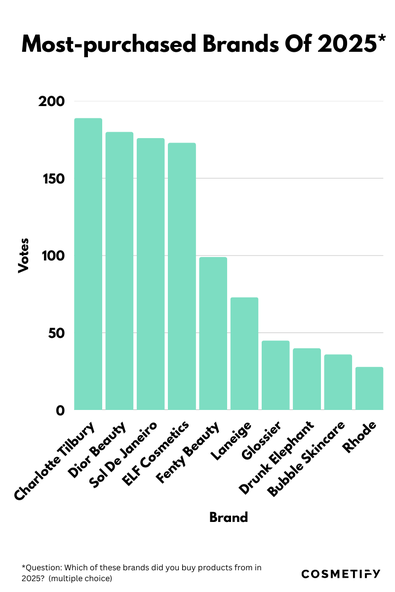

2. The UK’s Most-purchased Beauty Brands of 2025

Charlotte Tilbury leads, with Dior Beauty and Sol de Janeiro close behind.

Beauty buying habits in 2025 reveal a competitive landscape where luxury icons, viral favourites and value-driven brands sit side by side in shoppers’ baskets. This year, Charlotte Tilbury emerged as the UK’s most purchased beauty brand, securing a narrow lead over Dior Beauty, Sol de Janeiro and E.L.F. Cosmetics. The combination of legacy beauty players and new-age favourites also highlights how you can never be too comfortable; brands can lose their grip and fall out of favour at any time.

These results reflect a market that rewards performance, cultural relevance and virality, with brands succeeding through a mix of quality, storytelling and social momentum.

Key Insights

Charlotte Tilbury retains its position as the UK’s most-shopped beauty brand.

Almost 40% (189/484) of those surveyed bought from Charlotte Tilbury in 2025, giving the brand the lead. Its blend of premium formulas, universally flattering shades, hero products and high-performing newness keeps it firmly at the centre of UK makeup routines.

Dior Beauty holds its strength as the top premium powerhouse.

Dior Beauty comes in a close second (purchased by 37% of respondents), reflecting strong loyalty within prestige categories. Previously known for its fragrances, viral releases like the Dior Lip Oil show that this ‘mature’ brand can move with the times. Its consistent performance highlights the enduring value placed on luxury heritage brands.

Sol de Janeiro continues its explosive rise into mainstream beauty habits.

Previously known as a summer favourite, Sol de Janeiro now sits comfortably within year-round shopping behaviour. The rise of body mists, scent-sory bodycare and extensive #perfumetok layering rituals are driving this shift, helping the brand climb to third place.

E.L.F. Cosmetics dominates among value-driven shoppers.

At 173/484 (36%) votes, E.L.F. continues to outpace competitors in the budget and mid-range space. Its viral launches (e.g. the Power Grip Primer), TikTok influence and high-impact formulas have made it a staple for younger shoppers seeking affordable innovation.

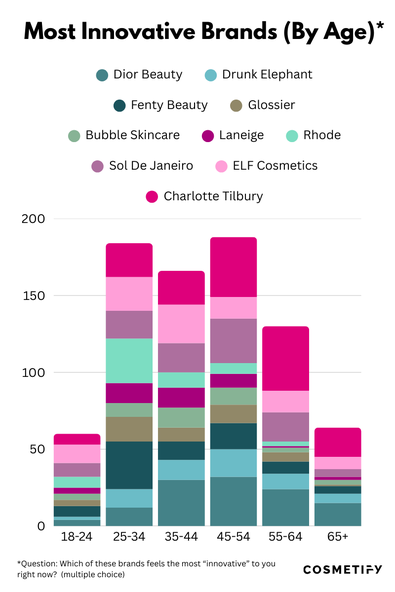

3. Brand Innovation Index

Rhode leads with Gen Z and millennials, but Charlotte Tilbury wins the innovation vote among mature consumers.

Innovation continues to be a major driver of attention in the beauty space, but this year’s results reveal a growing generational divide in which brands shoppers believe are pushing the industry forward.

While Charlotte Tilbury earns the highest overall innovation score, younger audiences overwhelmingly credit emerging brands like Rhode with shaping beauty in new and unexpected ways. 27% of 18 to 34-year-olds credited Rhode for innovation, whereas Charlotte Tilbury got 22% of the votes. This should come as no surprise to those who witnessed the Rhode phone case taking the beauty world by storm.

Among older consumers, established industry leaders dominate the innovation conversation. Particularly Dior Beauty and Charlotte Tilbury, which outperform all other brands for those aged 45+. This presents risks for brands like Rhode. Is hedging all bets on Gen-Z’s fleeting attention spans a wise move? Or can they turn into a legacy brand like Dior to suit consumers at all stages of life?

Key Insights

18–34-year-olds think Rhode is more innovative than Charlotte Tilbury.

Despite placing seventh overall, Rhode’s influence is disproportionately strong with younger consumers. Its minimalist branding, creator-led identity and constant viral presence mean younger shoppers see it as one of the category’s biggest innovators, even more so than established names.

For those aged 45 and over, Charlotte Tilbury leads the innovation conversation.

With the ever-glamorous Charlotte Tilbury as the face of the brand, it’s no surprise that her products resonate with the mature beauty-lovers. With an array of formulations catered to both young and ageing skin, the brand covers all bases with its skincare and makeup.

Charlotte Tilbury remains the overall innovation leader.

While generational splits reveal nuanced preferences, Charlotte Tilbury maintains a broad market appeal. Its constant flow of newness, hybrid formulas and social-first marketing secures its position as the UK’s most widely recognised innovator overall.

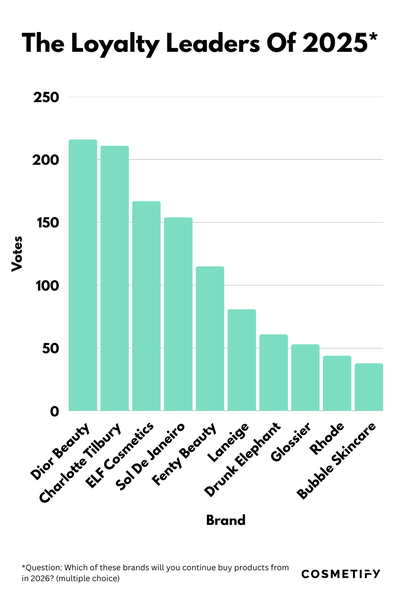

4. The Loyalty Leaders: Brands Shoppers Will Repurchase in 2026

Dior Beauty leads the UK’s loyalty rankings, followed closely by Charlotte Tilbury and E.L.F. Cosmetics.

Repeat purchase intention is one of the strongest indicators of long-term brand strength — and this year’s data shows a clear hierarchy emerging between heritage powerhouses, viral favourites and affordable innovators. Dior Beauty claims the top loyalty position overall, with more shoppers planning to repurchase from Dior than any other brand in 2026. Close behind are Charlotte Tilbury and E.L.F. Cosmetics, each securing a substantial base of returning customers.

Meanwhile, Sol de Janeiro and Fenty Beauty show impressive momentum, revealing that scent-led bodycare and celebrity-backed brands continue to shape UK beauty habits.

Key Insights

Dior Beauty is the UK’s most loyalty-led beauty brand.

With 216 (44%) of respondents planning to repurchase, Dior Beauty secures the strongest loyalty result across the entire category. This reflects the continued dominance of premium, heritage brands whose reputation for quality remains a core driver of repeat buying.

Charlotte Tilbury maintains strong loyalty across age groups.

Charlotte Tilbury’s 211 (43%) repurchase votes place it in a very close second position. Its hybrid formulas, constant newness and strong Millennial and Gen Z engagement keep it firmly embedded in shoppers’ long-term routines.

E.L.F. Cosmetics turns affordability into ongoing customer retention.

E.L.F.’s 167 loyalty votes highlight the brand’s ability to convert accessible pricing into sustained repeat use. Its viral launches and “high performance, low cost” ethos continue to resonate with value-driven shoppers. Particularly popular with Gen-Z (18 to 24-year-old) shoppers, 61% of whom confirmed that they will repurchase the brand next year.

5. What Factors Influence Beauty Purchases?

Quality beats price, even in a cost-of-living crisis.

At a time when household budgets remain under pressure, beauty shoppers are becoming more selective, not cheaper. The data shows that product performance and quality overwhelmingly dominate purchase behaviour, with nearly three-quarters of respondents saying it’s the most important factor when deciding what to buy. This suggests that consumers expect brands to justify every penny with visible, reliable results.

Trust, reputation and value still matter, but they take a secondary role. Meanwhile, influencers and sustainability, once assumed to be major drivers, appear far less influential than industry narratives suggest.

The Top Beauty Purchase Drivers by Dorothy EdgarKey Insights

Quality outranks price, even during economic uncertainty.

With 348 (71.9%) votes, product performance and quality are the clear #1 purchase driver. This reinforces a wider industry shift reported by Euromonitor: consumers are willing to pay for formulas that deliver visible results.

Brand trust matters nearly as much as quality.

Brand reputation is the second-highest factor, with 268 (55%) votes. Heritage brands, science-backed skincare and brands with strong track records benefit most from this trust-first behaviour.

Discounts and affordability still play a role, but they’re not the top priority.

Even when prices are at an all-time high, sales and affordability rank below quality and trust. Shoppers want value, not necessarily the cheapest options.

Influencers have far less sway than expected.

Just 82 respondents selected influencer or celebrity recommendations, meaning fewer than one in three younger shoppers say creators have a meaningful influence on their beauty purchase decisions.

Sustainability remains a low-priority driver.

With only 58 (12%) of the votes, sustainability ranks as one of the least important purchase factors. This suggests a disconnect between how much consumers say they value sustainability and how much it actually shapes buying behaviour.

6. Generational Beauty Trends: Gen Z, Millennials & Boomers

Gen Z is leading the shift to budget innovation, whereas Millennials and Boomers remain loyal to luxury.

Beauty behaviours are becoming increasingly generational, with Gen Z and Millennials showing distinctly different priorities when it comes to brands, innovation, and what drives them to purchase. While younger shoppers are gravitating toward affordability, viral product formats and creator-led brands, Millennials continue to anchor the market with a strong preference for trusted heritage names and premium performance.

These demographic differences reveal a beauty landscape where innovation and loyalty diverge sharply by age group; a dynamic that brands will need to navigate strategically in 2026.

Key Insights

Gen Z cite attractive packaging and virality as one of their key purchase drivers.

For younger shoppers, aesthetics and cultural momentum matter. 38.2% of 18 to 24-year-olds cited attractive packaging and social media buzz as some of their top reasons for buying these beauty brands. By comparison, only 18.46% of 25 to 34-year-olds cite attractive packaging as one of their purchase drivers. This reinforces the power of visual design and trend cycles in shaping Gen Z’s purchase decisions.

7. What Shoppers Want to See More of in 2026

Beauty shoppers want innovation, affordability and hybrid products in 2026.

What Shoppers Want More of in 2026* by Dorothy Edgar8. The Decline of Influencer Power

Influencers are losing their grip on beauty buying decisions, data suggests.

Despite the constant presence of creators on TikTok and Instagram, their direct influence over what people buy appears to be fading. Our survey shows that influencers and celebrities were selected as a purchase driver by just 82 respondents (out of 484), one of the lowest counts across all factors measured.

This insight aligns closely with the "de-influencing" trend, which highlights a cultural move toward authenticity, transparency and consumer-first thinking. Shoppers are increasingly sceptical of paid partnerships, overly curated content and hyper-dramatic product claims. Instead, they show stronger loyalty toward trusted brands, transparent formulas and products recommended by real users rather than public figures.

This doesn’t mean creators are irrelevant, but it does suggest a new landscape where influencers inspire awareness, not necessarily conversion, could be on the horizon. For brands, this means leaning into honest storytelling, user-generated content and proof-based marketing that still resonates even outside the hype-cycle.

Key Insights

- Only 82 out of 484 respondents said influencers or celebrities affected their purchase decisions.

- Brand trust, performance and reputation ranked dramatically higher than influencer impact.

Conclusion

While shoppers are becoming increasingly selective, they are not becoming less engaged. Instead, they are demanding more from the brands they trust. More performance, more transparency, more innovation and more value.

Across every demographic, product performance and quality emerged as the strongest purchase driver, reinforcing a shift toward evidence-led beauty. Even in the midst of economic uncertainty, consumers are proving willing to invest in products that genuinely deliver results. Heritage powerhouses like Dior Beauty and modern icons like Charlotte Tilbury remain central to UK beauty routines, while E.L.F. Cosmetics, Sol de Janeiro and Rhode demonstrate the rising power of affordability, sensory storytelling and culturally-driven branding.

The data also highlights a clear generational divide, with Gen Z and young Millennials seeking trend-led aesthetics and social-first innovation. Whereas more mature consumers stay loyal to legacy brands.

Finally, while sustainability ranked low as an active purchase motivator, the strong desire for refills and eco-friendly packaging shows that shoppers still expect brands to make responsible choices. The future of sustainable beauty is not about consumers changing behaviour; it is about brands integrating greener solutions seamlessly into the products people already love.

Taken together, these insights paint a picture of a beauty consumer who is savvy, values-driven and increasingly demanding of innovation that feels both meaningful and accessible. Brands that combine substance with creativity and pair performance with authenticity are best positioned to thrive in 2026 and beyond.

Methodology

This report is based on a survey conducted by Cosmetify between Friday, 6 June 2025 and Wednesday, 1 October 2025. The aim was to capture the attitudes towards the top 10 brands of 2024 (according to The Cosmetify Index). General behavioural questions were also included to uncover purchase patterns of beauty consumers across the UK. A total of 484 respondents participated, providing insights into their purchasing habits, brand preferences and expectations for the year ahead.

Data was cleaned and analysed using Python, with multi-choice responses separated into individual selections to measure true association strength across brands, innovation perception and purchase drivers. All percentages were calculated using unique respondents per demographic segment, ensuring an accurate reflection of shopper behaviour.

Respondents were segmented by age and shopping behaviour, allowing us to identify meaningful differences between Gen Z, Millennials and older beauty consumers. No statistical weighting was applied.

The findings in this report highlight the most significant beauty trends emerging as we move into 2026, offering an up-to-date snapshot of changing consumer priorities and brand momentum within the UK beauty market. Full data set here.

For more information or commentary, please contact press@cosmetify.com.

Top Posts